Why Instant Swaps Could Replace Traditional Crypto Exchanges

Blog

Master Crypto Compare and Backtesting: Optimize Your Cryptocurrency Portfolio with AI-Powered Insights

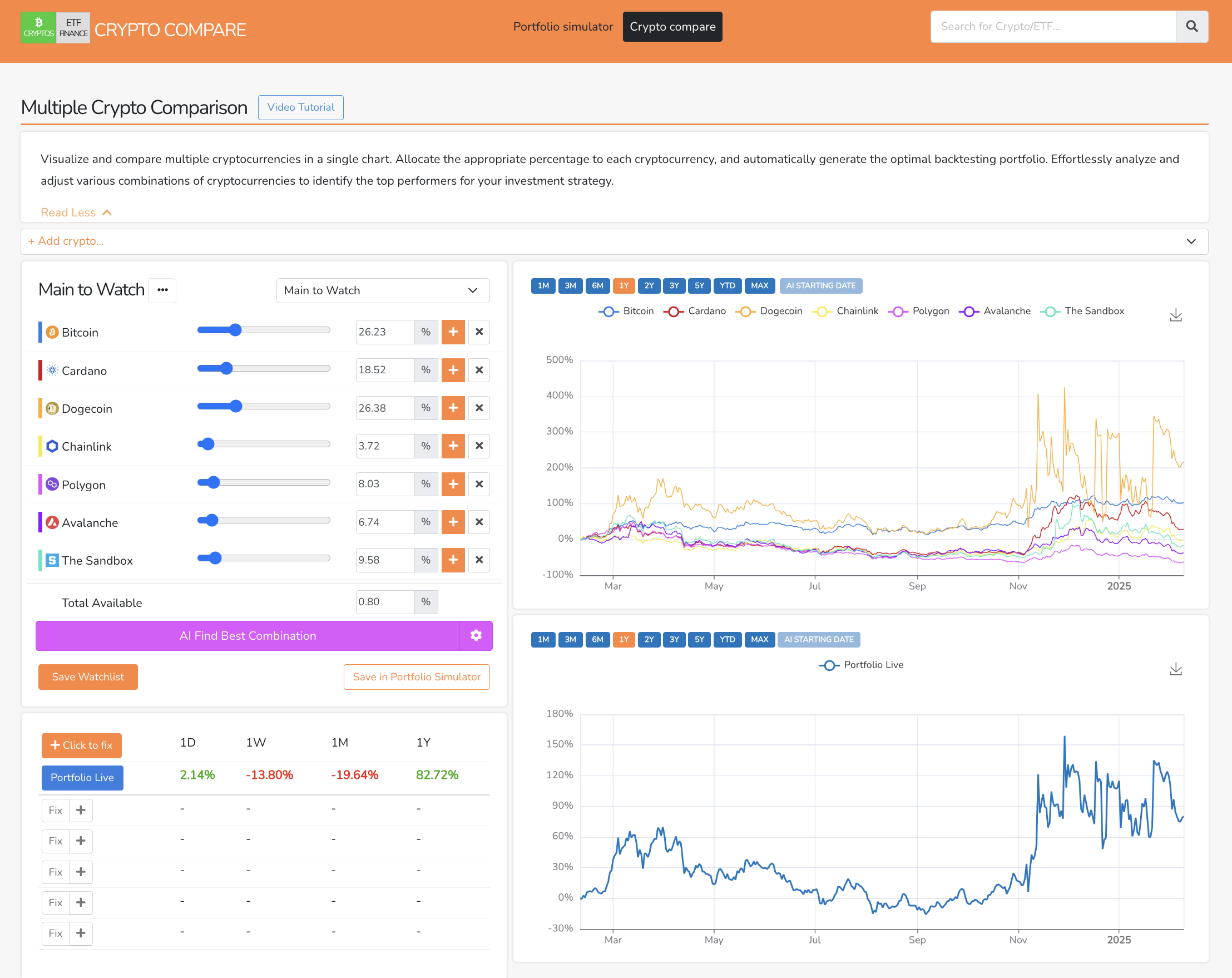

The cryptocurrency market is as thrilling as it is unpredictable. For both seasoned investors and beginners, understanding past trends, predicting potential returns, and optimizing portfolios can be challenging. Enter Final Crypto Tool’s "Crypto Compare", a revolutionary platform designed to make managing and maximizing your crypto investments effortless. Packed with features like portfolio simulation, backtesting, and AI-driven optimization, this tool is your ultimate guide to smarter crypto investing (see also the Exchange Traded Funds ETF Compare version)

What Is the Crypto Compare Tool?

Final Crypto Tool’s Crypto Compare is a user-friendly platform designed to help you:

- Compare the performance of multiple cryptocurrencies.

- Simulate portfolios to assess historical outcomes.

- Use AI-powered optimization to create the best portfolio tailored to your preferences.

Whether you’re exploring Bitcoin, Cardano, Dogecoin, or smaller altcoins, Crypto Compare empowers you with the tools and insights to make informed investment decisions.

How Does It Work?

The platform is centered around an intuitive dashboard where you can:

- Add cryptocurrencies to your portfolio.

- Adjust their weight to simulate different allocations.

- Analyze performance through advanced charts and metrics.

Crypto Compare doesn’t just show you numbers—it gives you the bigger picture. Whether you’re assessing returns over a week, a month, or a year, this tool presents clear, detailed insights into your portfolio's performance.

Key Features of Crypto Compare

1. Portfolio Simulation

Crypto Compare lets you visualize and test multiple portfolios. Select cryptocurrencies, assign percentage weights, and see how they would have performed historically. This simulation provides invaluable context, allowing you to:

- Test diverse investment strategies.

- Understand risk-return dynamics.

- Compare cryptocurrencies side by side.

For example, if you’re deciding between a Bitcoin-heavy portfolio or a balanced allocation with altcoins like Cardano and Polygon, Crypto Compare shows you how each scenario would play out.

2. AI-Powered Optimization

The standout feature of Crypto Compare is its AI Optimization Tool, highlighted in purple on the dashboard. Here’s how it works:

- Customizable Parameters: You set conditions like the number of assets, weight distribution, target returns, and maximum allowable drawdown.

- Automated Analysis: The AI evaluates the chosen cryptocurrencies and finds the best allocation for your portfolio.

- Comprehensive Results: The analysis includes optimal weight distribution, performance metrics, risk assessment, and projections.

The AI doesn’t just save time—it ensures precision. With advanced algorithms working in your favor, you can build a portfolio that aligns perfectly with your goals.

3. Fix Section for Portfolio Comparison

The Fix Section enables you to lock a resulting portfolio allocation, either from a manually created combination or one optimized by the AI. This locked portfolio can then be compared to other configurations generated either manually or through AI optimization. Here's how it works:

- Fix a portfolio you’ve designed or one recommended by the AI.

- Compare it to other resulting portfolios to evaluate their performance.

- Analyze differences in cumulative returns, volatility, and risk metrics between fixed and alternative combinations.

For example, you can:

- Lock a manually created portfolio that has 40% Bitcoin, 30% Dogecoin, and 30% Cardano.

- Compare it to an AI-optimized portfolio that includes additional assets like Avalanche or Chainlink.

This feature is ideal for testing multiple strategies side by side, helping you identify the best-performing portfolio under varying conditions.

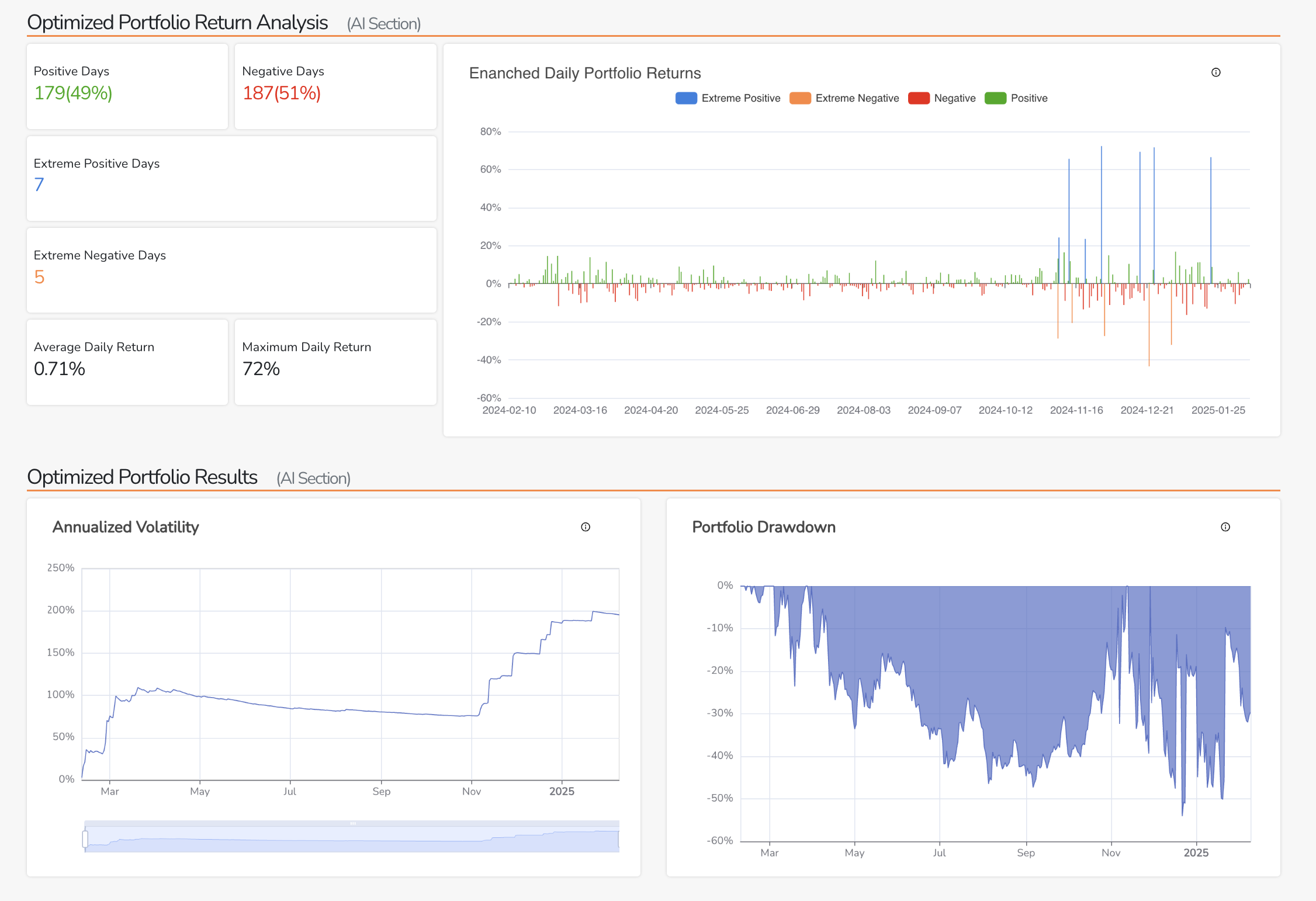

4. Backtesting for Historical Insights

Understanding how your portfolio would have performed in the past is crucial to refining your strategy. Crypto Compare offers:

- Cumulative Returns: See the overall profit or loss during the backtesting period.

- Maximum Drawdown: Identify the largest drop in portfolio value to gauge risk.

- Sharpe Ratio: Evaluate risk-adjusted returns.

- Volatility Metrics: Understand how stable or risky your portfolio might be.

Backtesting isn’t just about looking back—it’s about learning from the past to improve your future investments.

What Makes Crypto Compare Unique?

1. Rich Data Visualization

The tool’s dashboard displays performance metrics in easy-to-understand graphs and charts. From daily return analysis to risk-return comparisons, every metric is presented clearly, helping you make decisions with confidence.

2. Correlation Heatmaps

Diversification is critical to minimizing risk, and Crypto Compare’s Correlation Heatmap is a game-changer. It shows how your selected cryptocurrencies interact, helping you balance your portfolio with assets that complement each other rather than moving in lockstep.

3. Optimized Portfolio Suggestions

The AI doesn’t just give you numbers—it explains why a specific portfolio is optimal. This level of insight transforms your investment approach, empowering you to act with clarity and conviction.

Step-by-Step: How to Use Crypto Compare

- Select Cryptocurrencies: Start by adding your preferred digital assets to the list (e.g., Bitcoin, Dogecoin, Chainlink).

- Adjust Allocations: Use sliders to assign percentage weights to each cryptocurrency.

- Run AI Optimization: Define your parameters, like maximum drawdown or target returns, and let the AI find the best combination.

- Review Results: Analyze detailed performance metrics, from annualized returns to volatility.

- Use the Fix Section: Lock a portfolio, either manual or AI-generated, and compare it with other configurations to find the most effective strategy.

Who Benefits from Crypto Compare?

For Beginners

If you’re new to crypto, Crypto Compare simplifies portfolio management. Experiment with different strategies, understand historical trends, and learn about risk diversification—all in one place.

For Experienced Investors

Advanced users can refine their strategies using backtesting and AI optimization. The tool’s detailed metrics provide the precision needed to craft high-performing, low-risk portfolios.

Real-Life Example

Imagine you’re interested in Bitcoin, Dogecoin, and Avalanche. Here’s how Crypto Compare enhances your strategy:

- Add the three cryptocurrencies to your portfolio.

- Adjust their weights to test different combinations, such as:

- 50% Bitcoin, 30% Dogecoin, 20% Avalanche.

- 70% Bitcoin, 15% Dogecoin, 15% Avalanche.

- Run the AI Optimization tool to see which allocation offers the best risk-adjusted returns.

- Use the Fix Section to lock an AI-optimized portfolio and compare it with a manual configuration that emphasizes Bitcoin or other cryptocurrencies.

- Analyze detailed metrics like cumulative returns and risk exposure to make your decision.

In just minutes, you’ve transformed raw data into actionable insights.

Why Choose Final Crypto Tool's Crypto Compare?

The crypto market is fast-paced and unpredictable, but with the right tools, you can stay ahead. Crypto Compare combines simplicity with sophistication, offering:

- Advanced AI algorithms for optimization.

- Intuitive tools for backtesting and benchmarking.

- Powerful data visualizations that make complex analytics easy to understand.

Final Thoughts

Final Crypto Tool’s Crypto Compare is more than just a portfolio simulator—it’s a comprehensive platform for smarter investing. Whether you’re crafting your first portfolio or fine-tuning an advanced strategy, this tool equips you with everything you need to succeed.

Start using Crypto Compare today and unlock the full potential of your crypto investments. Your portfolio deserves it!

More related articles

Federal Reserve Chair Jerome Powell's recent address at the Jackson Hole Economic Policy Symposium highlighted critical insights into the current economic landscape and the Fed's future monetary policy. He noted the U.S. economy's resilience, characterize

PayPal is making waves in the stablecoin sector with its introduction of PayPal USD (PYUSD), which offers users a notable 3.7% annual return on their balances. This initiative aims to boost user engagement and differentiate PayPal from established competi