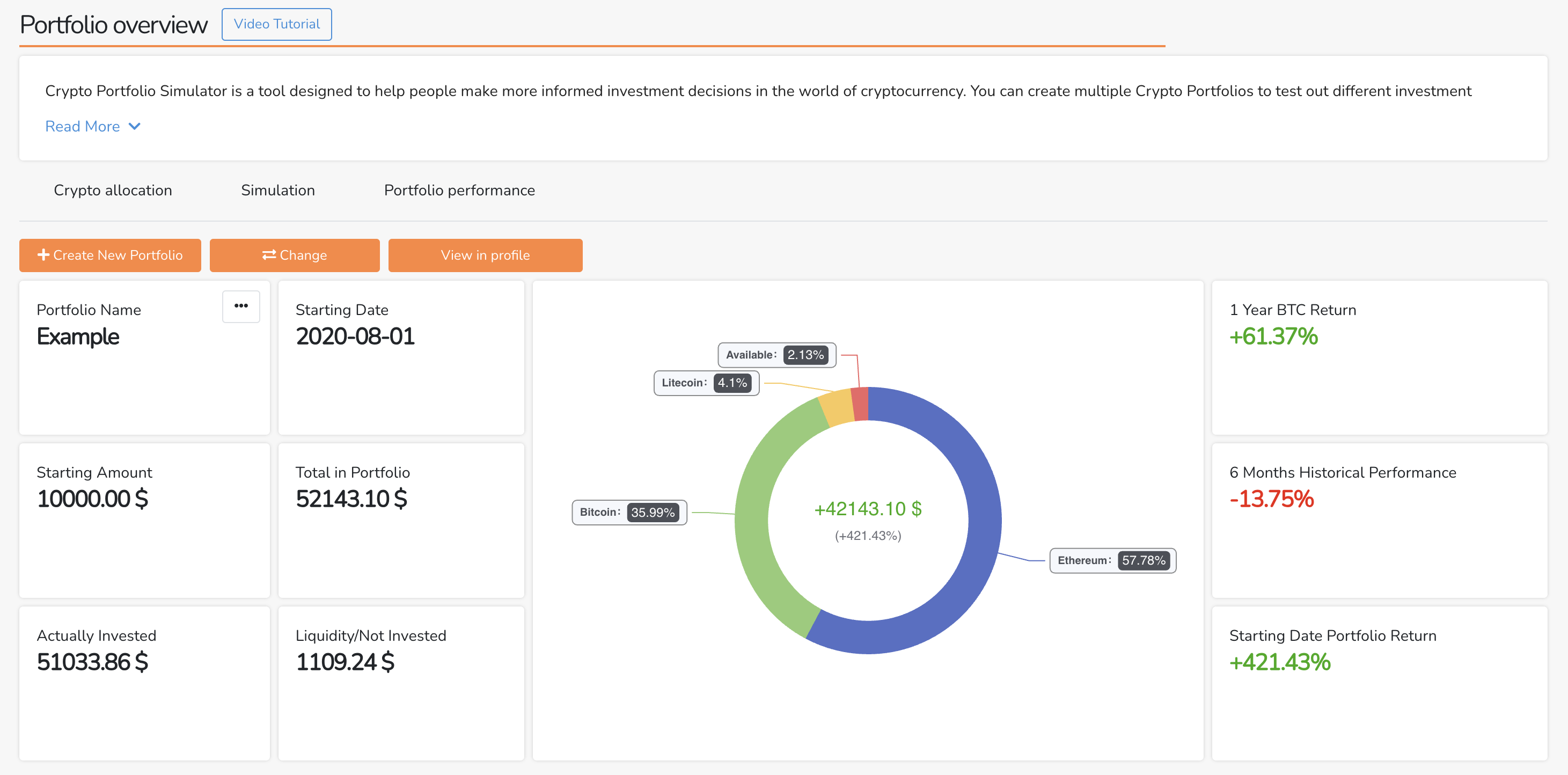

The article discusses the significance of using a Crypto and ETF Portfolio Simulator for modern investment strategies. It highlights the tool's value in allowing investors to test strategies risk-free, analyze historical performance, and optimize asset al

Blog

Portfolio Simulator 2025

Introduction: Why You Need a Portfolio Simulator for Crypto and ETF Investments

We find ourselves in a rapidly changing financial landscape where digital assets, particularly cryptocurrencies, and Exchange-Traded Funds (ETFs), are no longer just side interests but essential components of modern investment strategies. As traditional and digital finance converge, having a robust tool like the Crypto and ETF Portfolio Simulator becomes indispensable.

Why should one consider this tool, you might ask? Well, diving into investments without thorough testing can lead to costly mistakes, especially amidst market volatility. Whether you're dabbling in Bitcoin, Ethereum, crypto ETFs, or a more intricate mix of digital and traditional assets, an advanced portfolio simulator is not merely beneficial; it’s essential for serious investors.

With this simulator by your side, you can engage in insightful strategy testing, analyze historical performance, and optimize your asset allocation—all without putting hard-earned capital at risk.

Key Benefits of Using an Advanced Portfolio Simulator

- Risk-Free Strategy Testing: Tinker with different allocations without any financial repercussions.

- Historical Performance Analysis: Understand how past market behaviors could inform future decisions.

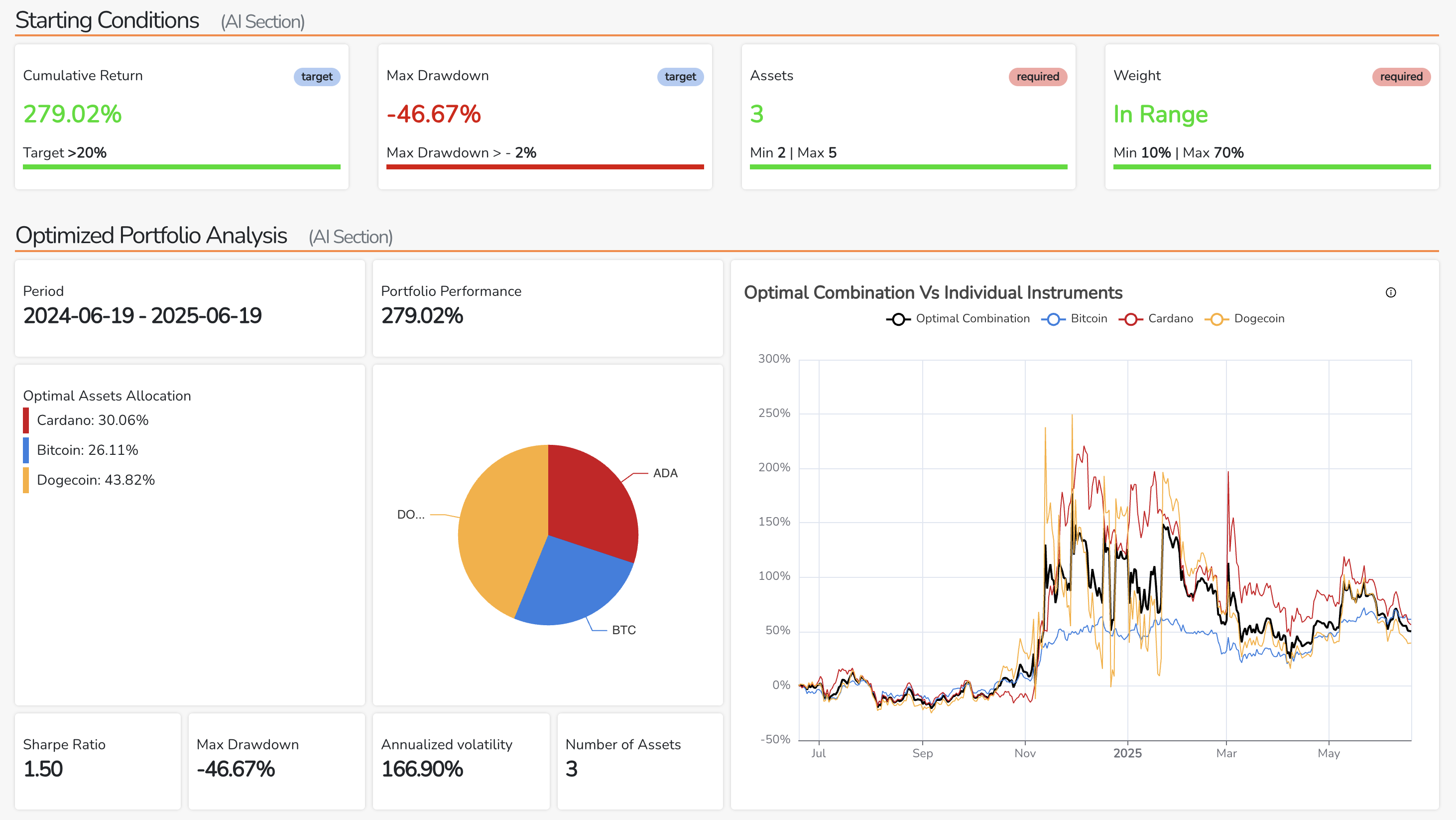

- AI-Powered Optimization: Leverage cutting-edge technology for institutional-grade portfolio refinement.

- Real-Time Market Integration: Stay current with live market data to make informed decisions.

In today’s investment climate, where agility and informed decisions are critical, the integration of artificial intelligence empowers individual investors to achieve optimization levels previously reserved for institutional players.

Getting Started with the Portfolio Simulator

Navigating the Final Crypto Tool Portfolio Simulator is a breeze, even for those who may feel overwhelmed by portfolio creation. Let’s walk through the straightforward steps you’d need to take.

-

Select Your Assets: Start by picking your favorite cryptocurrencies or ETFs from an extensive list—think Bitcoin, Ethereum, and the various sector-leading ETFs.

-

Choose Your Allocation Method:

- Manual Allocation: Control your investments by setting specific percentage allocations tailored to your preferences directly from Portfolio Simulator

- AI-Optimized Allocation: Allow the AI to analyze your selected assets and suggest an optimal mix, drawing from a wealth of historical data and performance metric. Do that in Compare Chart

The beauty of AI here is its capacity for deep analysis. For those inclined to explore multiple assets, the AI can even suggest the most effective distribution based on parameters you provide, such as your risk tolerance or timeline.

As you experiment, the interface updates dynamically, providing immediate feedback visually as you tweak your allocations. You can easily create separate portfolios focusing solely on cryptocurrencies or ETFs, allowing for deeper insights into each asset class's unique behavior.

Key Features of the Advanced Portfolio Simulator

Real-Time Portfolio Performance Tracking

The simulator goes beyond rudimentary tracking; it offers real-time performance metrics that encompass live price updates, percentage shifts, and a neat calculation of your total portfolio value. Daily charts afford granular insights while longer-term charts highlight overarching trends that may influence strategic shifts.

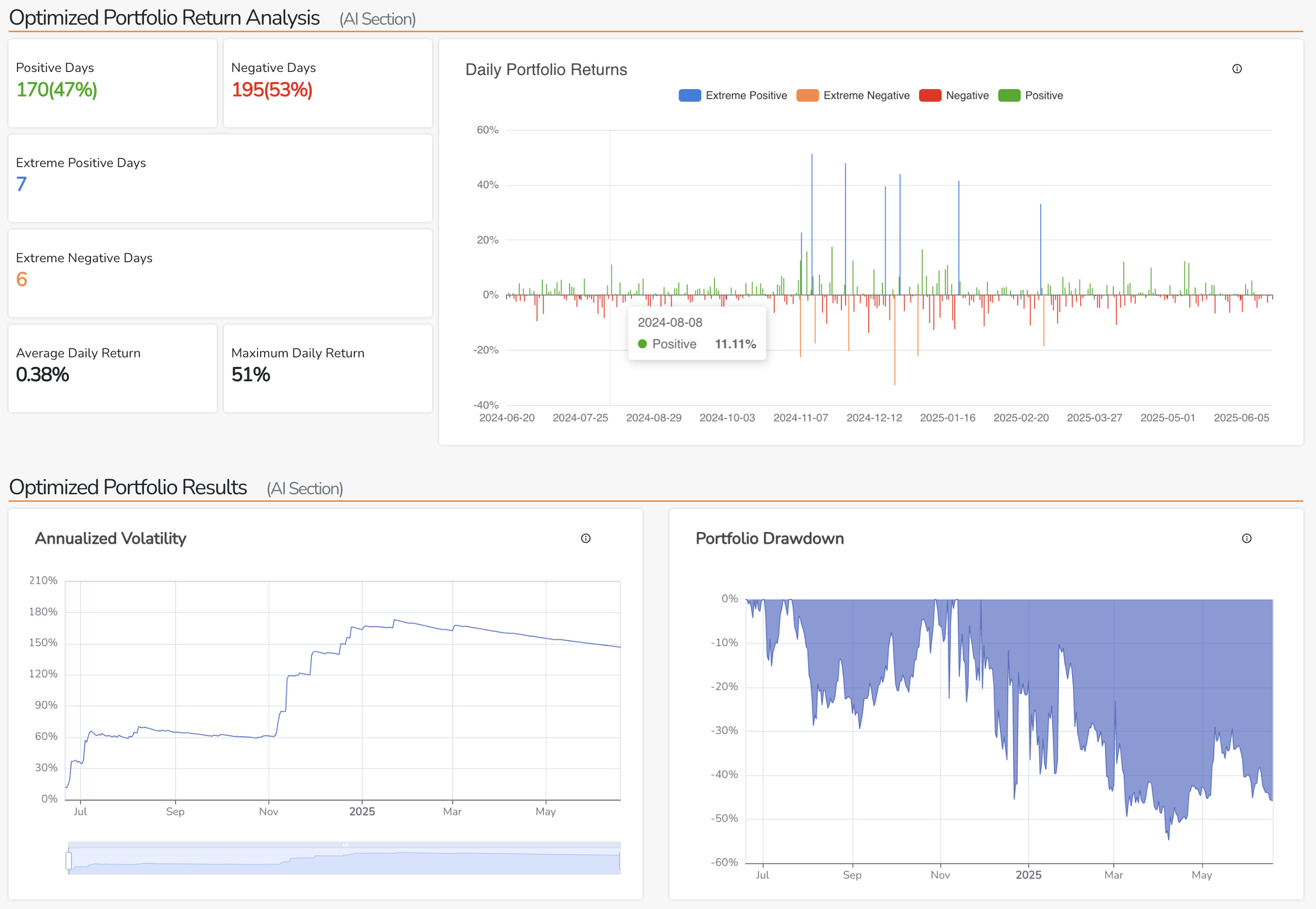

But we don't just stop at profits and losses. This platform keeps a watchful eye on critical performance metrics—think volatility measures and Sharpe ratios. Understanding how efficiently your portfolio has performed relative to risk is essential in the world of investing, and here, you’re equipped with that knowledge.

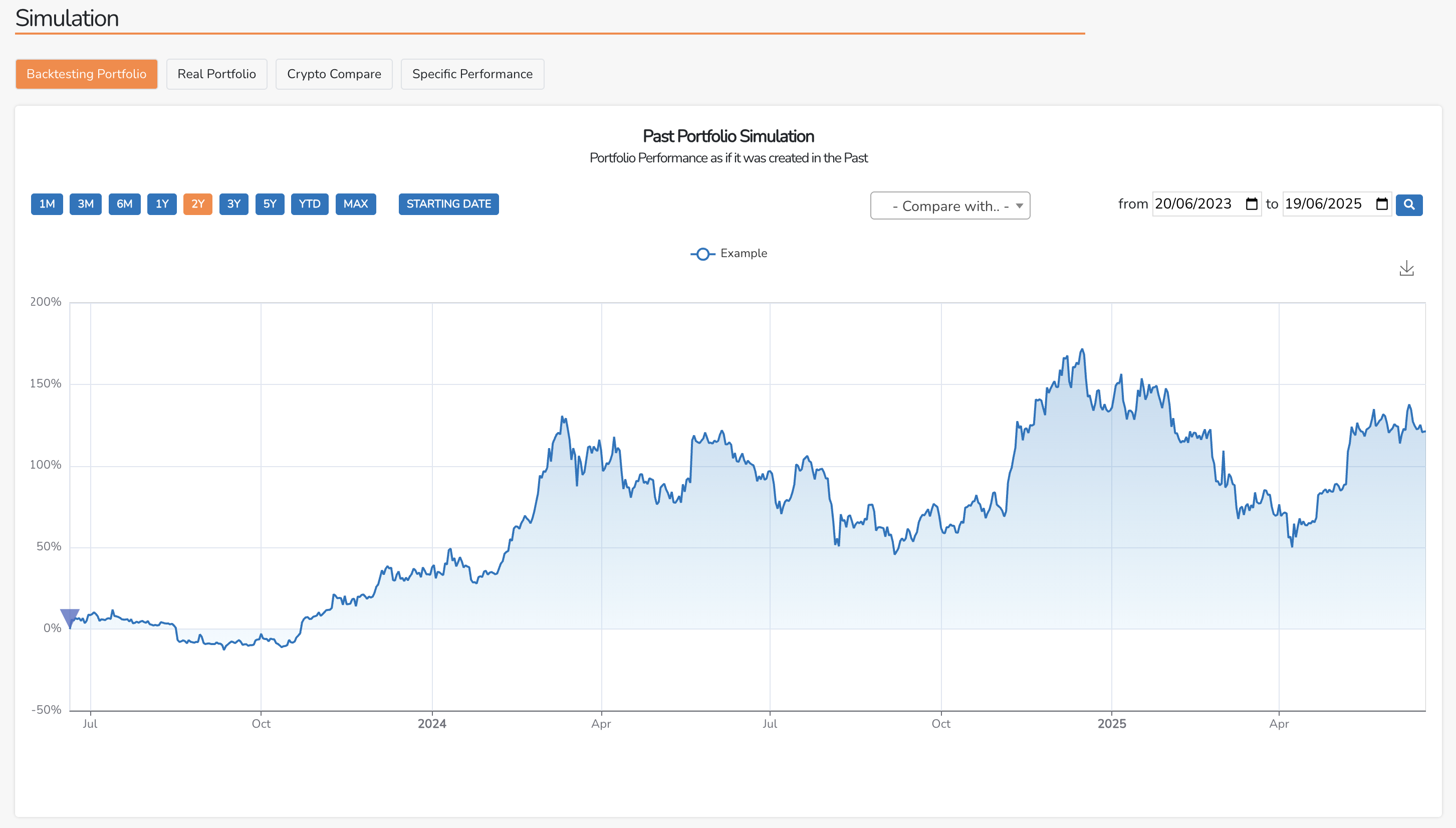

Historical Performance Analysis and Backtesting

Imagine wanting to understand how your portfolio might have fared during market upheavals or peaks—this is where backtesting shines. By simulating past market conditions, whether during the chaotic moments of the 2020 crash or the euphoric bull run of 2021, you can examine how your digital and traditional assets would interact.

The platform allows you to set customizable date ranges, giving you the flexibility to explore everything from short-term strategies to long-term investments. It’s like having a time machine for your portfolio, revealing periods of vulnerability or resilience with ease.

Portfolio Diversification Intelligence

Diversification is the name of the game when it comes to risk management. The simulator empowers you to visualize your asset distribution through engaging pie charts and tables, alongside critical correlation calculations between various assets. This feature is invaluable for crafting portfolios resilient to market fluctuations.

Moreover, proactive notifications alert you when you might be over-concentrating on a specific asset or sector—arguably a common pitfall among investors that can lead to unexpected losses.

AI-Powered Tools for Enhanced Decision Making

Portfolio Allocation Optimization

Utilizing AI, the simulator optimizes your portfolio allocations based on a comprehensive analysis of the assets you've picked. This tool considers historical performance, volatility patterns, and even how these assets correlate with one another, finding that sweet spot of effective balance for you.

Configurable settings enable personalization—choose parameters that reflect your comfort with risk or allow the AI to operate on default settings for an automated solution. This is particularly helpful when handling varied assets and seeking that optimal allocation strategy.

AI-Powered News Analysis

Staying ahead of the curve is paramount, which is why the platform embeds a sophisticated AI system for news analysis. Through this feature, one can:

- Conduct Sentiment Analysis: Gauge whether news is good, bad, or neutral for your investments.

- Assign Importance Ratings: Focus efforts on developments that could dramatically impact performance.

- Receive Real-Time Updates: Stay informed with the latest news as it breaks.

- Contextualize Market Developments: Understand news in relation to how it might affect your portfolio.

By integrating market news with your investment strategies, this tool ensures you remain proactive rather than reactive in your decision-making.

Advanced Tools and Complementary Features

Comprehensive Backtesting Capabilities

The simulator excels with its backtesting engine, presenting various options for visualizing portfolio performance over time. Filter results by different dates, benchmark against other strategies, and even export data for in-depth analysis. By accounting for essential factors like transaction costs, backtesting reflects practical trading scenarios.

Multi-Portfolio Comparison

Another standout feature is the capacity for creating and comparing multiple portfolios at once. This allows not only for sophisticated strategy testing but encourages community learning through collaboration and comparison. Users can opt to make their portfolios public, creating a dynamic space where successful methodologies can be analyzed and learned from.

The Portfolio Leaderboard adds an exciting competitive edge. By ranking public portfolios on performance metrics, users can:

- Learn from successful strategies

- Gain community recognition

- Participate in a network of informed investors

- Track personal performance against others

With future gamification elements such as rewards for top performers, the experience promises to be both educational and engaging.

Integration with Market Intelligence

The Crypto Compare Tool, a seamless extension of the simulator, allows for direct asset comparisons. This tool enhances your analysis, making it easier to test various combinations before committing to a portfolio.

Furthermore, extensive market intelligence features enrich your decision-making toolkit:

- News Feed with AI Analysis: A continuously updated feed offers sentiment-analyzed news.

- Whale Transaction Monitoring: Keep an eye on large transactions signaling market shifts.

- Historical Data Access: Dive into past performance intricacies.

- Real-Time Market Alerts: Instant notifications alert you to significant price movements.

Together, these capabilities empower investors to make well-informed tweaks to their portfolios based on solid, data-driven insights.

Optimizing Your Investment Strategy

Strategic Portfolio Approaches for Different Objectives

We can’t overlook that successful portfolio management hinges on experimenting with various allocation strategies. The simulator permits extensive exploration based on distinct investment goals:

- Long-Term Growth Focus: Invest in established assets with solid histories.

- Innovation and Emerging Markets: Play around with newer projects that are generating buzz.

- Income Generation: Explore assets offering dividends or staking rewards for additional income streams.

- Risk Mitigation: Formulate portfolios balancing volatility with relative stability.

Keep in mind these are merely illustrative strategies for simulation. The simulator's real advantage lies in helping investors understand how different strategies perform across various market scenarios, developing your own, well-informed approach in the process.

Dynamic Risk Management

Managing risk becomes increasingly nuanced when navigating multiple asset classes. The simulator allows users to understand individual asset behavior during market stress, prompting users to consider effective hedging strategies. Some might find that specific commodity ETFs serve as excellent hedges against crypto volatility.

Rebalancing is crucial too. The simulator illustrates how different rebalancing frequencies influence long-term returns. Whether it’s monthly, quarterly, or annually, experimenting through backtesting unveils what suits your particular style best.

Staying Informed and Adaptive

Effective portfolio management is not a “set it and forget it” affair. Positioning oneself to stay ahead requires dedication to staying current with market movements. The integrated news feed ensures important developments impacting both crypto and traditional markets are always at your fingertips. Keeping an eye on whale transactions can further provide critical insights into forthcoming market shifts.

This cocktail of AI-driven optimization, robust backtesting, and timely market intelligence creates a powerful ecosystem for effective portfolio management. Regularly utilizing these tools may help develop a sharper intuition about market dynamics, ultimately enhancing decision-making skills over time.

Conclusion: Empowering Your Investment Journey

The Final Crypto Tool Portfolio Simulator represents a paradigm shift in investment technology, merging sophisticated analytics with AI optimization to offer something truly revolutionary for individual investors.

Community-driven features like the public portfolio leaderboard cultivate a competitive yet educational atmosphere where strategies can be shared and refined. Whether testing new crypto strategies or exploring ETF allocations, this simulator delivers invaluable insights essential for well-informed investment decision-making.

As we venture deeper into an ever-evolving market landscape, the need for an effective simulation and optimization platform grows more critical. Dive into all the opportunities this simulator offers—experiment, validate your investment ideas, and see your portfolio potentially rise through rank. The future of investing is bright, accessible, and more engaging than ever before.

Disclaimer: This article is intended for informational and educational use only. It should not be considered financial advice; all investment decisions should be based on personal research and consultation with certified financial professionals. Past performance in simulations does not guarantee future results in actual markets.

More related articles

A seed phrase is a unique series of randomly generated words that serves as a "master password" to access or restore a digital wallet containing cryptocurrencies. Understanding its importance is crucial, as losing access to your wallet due to technical er

Discover how Cryptocurrency Development Services transform digital finance with blockchain, smart contracts, and global accessibility.